Successful Financial Audit 2024 Checklist

Successful Financial Audit 2024 Ultimate Guide, Checklist & Tips

With the third quarter of the year quickly approaching, it is time to begin looking at what your company’s next financial audit will entail. These financial audits play a pivotal role in providing assurance to the users of the financial statements about the true and fair view of the financial position of the company. Yes, auditing may seem challenging, but instead look at it as a necessary part of your business, a ‘health’ check-up for your financial information.

Fact Check: Did you know 60% of businesses face audit delays due to poor preparation? Contact Team Akram to ensure a seamless financial audit process.

The regular practice of auditing and reviews helps to make sure that the organization’s finances and reports are correct, hence making it easier for the business to cope with compliance, various rules, and making decisions.

What is a Financial Audit?

Financial audit is an objective assessment of the financial documents of the organization including financial statements, transactions and various activities, contracts and internal controls (in laymen terms). The certification process is concluded through the performance of an independent third party audit, resulting in an expressed opinion regarding the precision of financial statements. As a result, this opinion propels critical decision making such as getting funds through investment or loans, and enhancing measures related to financial management in the company.

Audits serve various purposes:

- Accuracy Verification: Ensuring the correctness of financial records and statements.

- Regulatory Compliance: Meeting legal requirements for state and federal financial regulations.

- Investor Assurance: Demonstrating the accuracy of financial statements to potential investors or lenders.

- Improvement of Internal Controls: Strengthening the company’s financial processes and systems.

Why is Auditing Important?

Audits, therefore, play a significant role in financial markets in the maintenance of trust. Companies are only free to misstate performance if they do not receive timely audits, giving them the impression of operating at levels higher than actual performance. Useable financial statements by firms consequently ensure the stakeholders' confidence. This includes investors, creditors, and possibly regulatory bodies. When such stakeholders do not trust the data, it lowers the readiness to communicate with the company.

Types of Audits

Audits can take different forms, depending on who conducts them and their purpose. Main types of audits are:

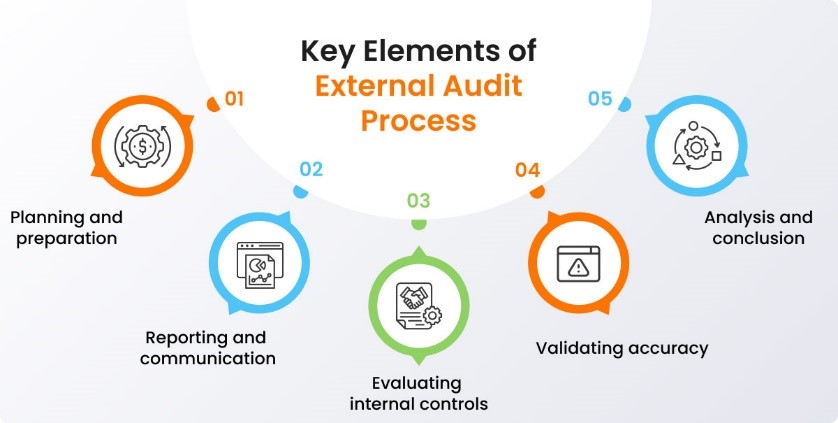

- External Audits: Ensuring the correctness of financial records and statements.

- Regulatory Compliance: Meeting legal requirements for state and federal financial regulations.

- Investor Assurance: Demonstrating the accuracy of financial statements to potential investors or lenders.

- Improvement of Internal Controls: Strengthening the company’s financial processes and systems.

Audit Preparation Checklist

When we talk about financial audits, audit preparation checklist is key to achieving a successful financial compliance. The goal is to ensure that the financial records are accurate and complete, enabling the auditors to issue a clean or unqualified opinion. Listed below are several audit planning tips and steps to help your organization prepare for an audit:

- Planning: Remember, audit preparation should begin well in advance—several months before the audit begins. Companies must allocate additional resources to ensure that everyone is aligned on audit expectations. Keeping financial records up-to-date throughout the year reduces pressure during the final weeks leading up to the audit.

- Stay Current on Accounting Standards Accounting rules and regulations can change from year to year therefore, keeping your finance team informed of updates from regulatory bodies ensures compliance and reduces the time needed for adjustments. This proactive approach helps prevent last-minute scrambling and smoothly lets the audit run when the season arrives.

- Assess Organizational Changes: If there have been any significant changes in the company since the last audit, these should be taken into account and must not be ignored. This could include new projects, changes in funding sources, internal control updates, or changes in accounting practices

- Learn from Previous Audits: Review the findings and recommendations from previous audits. Analyze any errors or weaknesses identified in the last audit and implement corrective actions. Addressing these issues in advance can make your next audit smoother.

- Set Timelines and Assign Responsibilities: Create a detailed timeline that outlines each task and its deadline, assigning responsibility to the appropriate team members. This ensures that no detail is overlooked and that the audit runs on schedule.

- Learn from Previous Audits: Ensure that all necessary documentation is readily available and well-organized to ensure smooth audits. Common documents required but are not limited to for an audit include:

- General ledger

- Financial statements

- Budgets

- Transaction records

- Invoices and bills

Preparing for Alternative Investment Fund Audits

If your company operates an alternative investment fund (AIF), there are additional complexities involved. These funds are required to adhere to US GAAP or IFRS standards, and specific rules, such as the ASC 946 (Financial Services – Investment Companies) and ASC 820 (Fair Value Measurements), must be followed when preparing financial statements.

In addition to the general audit preparation steps, focus on these AIF-specific areas:

- Fair Valuation of Investments: AIFs must determine the fair value of their investments using the best available market data or assumptions. The auditor will review the fund’s valuation methodology and the data supporting it.

- Internal Controls: A strong system of internal controls will help ensure that all investment transactions are accurately recorded and traceable

- Allocations: Proper documentation of capital allocations and management fees is essential to avoid challenges during the audit.

- Audibility: Ensure that all transactions, particularly those involving digital assets, are fully auditable

Five Key Steps for a Smooth Fund Audit

- Communication: Continue to speak freely with the assessor. Ask questions to make sure you understand the audit process well, and keep them updated on any major changes or problems.

- Interim Planning: Before the fiscal year concludes, start organizing the audit. Establish due dates for the submission of requested papers and start interim processes, such as risk assessment and key control review.

- Documentation: Be ready to supply any and all contracts, accounting records, and proof of internal controls that are asked for. Supporting documentation for significant decisions, such as investment valuations, is also included.

- Review: Verify the accuracy and completeness of accounting and financial accounts on a regular basis. Complete reconciliations and look for mistakes that auditors might notice.

- Winding Up: Ensure that all outstanding issues are resolved when the audit comes to an end. Sign letters of management representation, go over financial statements, and address any unanswered questions.

Conclusion

Financial audit preparation can be intimidating, but it can go lot more smoothly with proper planning and organization. By adhering to these rules, your business may guarantee a successful audit that proves the transparency and correctness of its financial accounts strengthening your company’s financial integrity & stakeholder’s confidence. Contact Team Akram today to learn how we can streamline your audit process.

Schedule a consultation today: 844-386-3829