Impact of President Trump’s April 2025 Reciprocal Tariffs Policy

The Impact of President Trump’s April 2025 Reciprocal Tariffs Policy

On April 2, 2025, President Trump signed an executive order establishing a landmark "Reciprocal Tariffs" policy, reshaping the U.S.'s international trade landscape. The new policy introduces a baseline tariff on all imports, effective at 12:01 a.m. EDT on Saturday, April 5, 2025, followed by country-specific tariffs beginning on April 9, 2025. The shift has significant implications for businesses, particularly those involved in importing goods from nations subject to these new tariffs. Below, we’ll break down the key details of the policy, its potential impacts on businesses, and steps companies can take to prepare.

Key Details of the Reciprocal Tariffs Policy

The executive order establishes two main components of the policy: a baseline tariff and country-specific tariffs.

1. 10% Baseline Tariff

Effective from April 5, 2025, a 10% tariff will be applied universally to all goods entering the United States. This baseline rate will immediately raise the cost of imports across the board, impacting businesses that rely on foreign-made products.

2. Country-Specific Tariffs

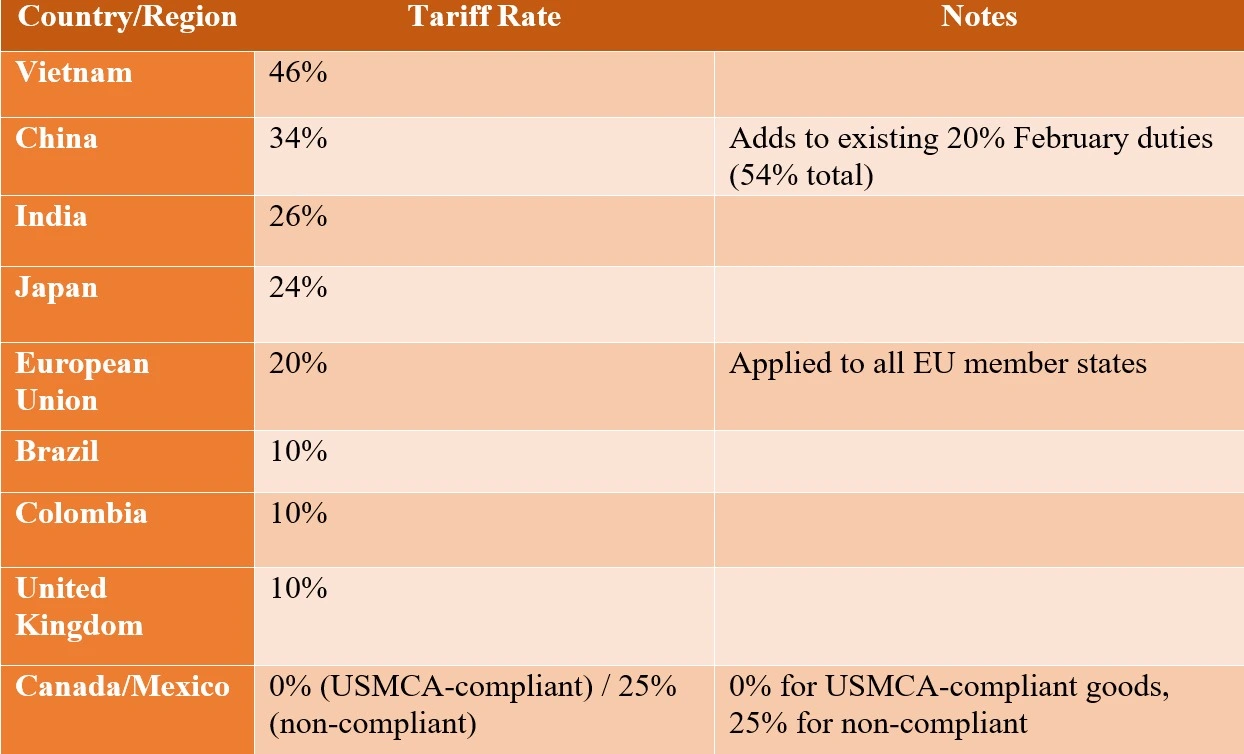

In addition to the universal 10% tariff, the policy includes higher "reciprocal" tariffs on select countries based on perceived trade imbalances. These rates, which come into effect on April 9, 2025, are detailed below:

This country-specific structure is a direct reflection of the U.S. administration’s aim to address what it perceives as trade imbalances with these nations. These higher tariffs are set to take effect on April 9, 2025, escalating costs on goods imported from certain regions.

Exemptions: What Stays the Same?

While the majority of goods will face higher costs due to the new tariffs, there are several exemptions to be mindful of:

USMCA-Qualified Goods

Goods that qualify under the U.S.-Mexico-Canada Agreement (USMCA) will remain tariff-free indefinitely. This is a significant relief for businesses trading with Canada and Mexico, as long as the goods in question meet the agreement’s compliance criteria.

Section 232 Goods

Certain items that are already subject to tariffs under Section 232—including automobiles and auto parts, steel, aluminum, copper, pharmaceuticals, semiconductors, lumber, critical minerals, and energy products—will not be impacted by the new Reciprocal Tariffs. These items will continue to carry their existing 25% tariffs.

Potential Impacts on Businesses

The introduction of the Reciprocal Tariffs policy will have several far-reaching consequences for U.S. businesses engaged in international trade.

1. Increased Costs of Imported Goods

The 10% baseline tariff will increase the cost of imported goods across the board. For businesses that rely on foreign suppliers, this could result in higher prices for raw materials, components, or finished products. Additionally, the country-specific tariffs will further exacerbate this impact, especially for businesses importing from nations like China, Vietnam, and India.

2. Supply Chain Adjustments

Companies may need to reconsider their supply chain strategies in light of these new tariffs. Rising costs may prompt businesses to explore alternative sourcing options, such as shifting to countries not subject to additional tariffs, or increasing domestic procurement where feasible. Supply chain diversification and strategic restructuring will be key in minimizing disruptions and mitigating the financial impact of the new tariffs.

3. Market Volatility

The announcement of these tariffs has already caused fluctuations in financial markets, signaling potential economic uncertainty. Businesses may need to prepare for market volatility, especially in sectors closely tied to international trade. Companies should consider hedging strategies, adjusting forecasts, and being prepared for shifts in consumer demand driven by price increases.

Key Steps for Businesses to Prepare

To navigate this evolving trade environment, businesses must take proactive measures to understand and mitigate the effects of these new tariffs.

1. Evaluate Exposure to Tariffs

The first step is to assess your business’s current reliance on imports from the affected countries. Companies should map out the proportion of their supply chain tied to nations subject to higher tariffs. This evaluation will help determine the potential financial impact and guide decisions on how to adjust sourcing strategies.

2. Explore Alternative Sourcing Options

If your business relies heavily on imports from tariffed countries, consider sourcing from regions not impacted by the new tariffs. Alternatively, you may want to explore reshoring or nearshoring opportunities, where goods can be sourced more locally. These options can help reduce dependence on tariff-impacted regions and lower the overall costs of doing business.

3. Review Existing Contracts

Businesses with international suppliers or customers should carefully review their contracts to understand the potential implications of rising costs. Contracts may need to be renegotiated to account for increased tariffs or new pricing structures. Transparent communication with suppliers and customers will be crucial to minimize disputes and maintain stable business relationships.

4. Stay Informed on Policy Changes

The landscape of international trade is always subject to change. With ongoing negotiations between the U.S. and its trade partners, businesses should stay informed about potential adjustments to the tariff rates or exemptions. Regularly monitoring updates from government sources or working with trade experts will help ensure that your business remains agile and responsive to shifting trade policies.

Conclusion

President Trump’s new Reciprocal Tariffs policy marks a significant shift in the U.S.’s trade strategy. With a 10% baseline tariff on all imports and country-specific tariffs targeting nations like China, Vietnam, and India, businesses will face higher costs and potential disruptions to their supply chains. To navigate these changes, it is essential for businesses to assess their exposure, explore alternative sourcing options, and stay updated on ongoing policy developments. By preparing in advance, companies can mitigate the impact of these tariffs and continue to thrive in an increasingly complex global trade environment.